child tax credit portal

You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account.

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

To apply applicants should visit portalctgovDRS and click the icon that says 2022 CT Child Tax Rebate.

. MyconneCT - Learn more about myconneCT. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. You must have claimed at least one child as a dependent on your 2021 federal income tax return who was 18 years of age.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. The application period will close on July 31 2022 and payments will be issued in August. Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The Child Tax Credit Update Portal is no longer available. You can no longer view or manage your advance Child Tax Credit.

This secure password-protected tool is easily accessible using a smart phone or computer with internet. Visit ChildTaxCreditgov for details. The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17.

Married filing jointly. Gas Tax - For updated information on the Suspension of the Motor Fuels Tax click here. The rest of your Child Tax Credit will be issued in one payment.

Sales tax relief for sellers of meals. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax. June 28 2021.

If you received any monthly Advance Child Tax Credit payments in 2021 you need to file taxes this year to get the second half of your money. You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year. Department of Revenue Services.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. To be eligible for this rebate you must meet all of the following requirements. The Child Tax Credit Update Portal is no longer available but you can see your advance payments total in your online account.

The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment. - Click here for updated information. The tool also allows families to unenroll from the advance payments if they dont want to receive them.

Have been a US. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. You must be a resident of Connecticut.

The Update Portal is available only on IRSgov.

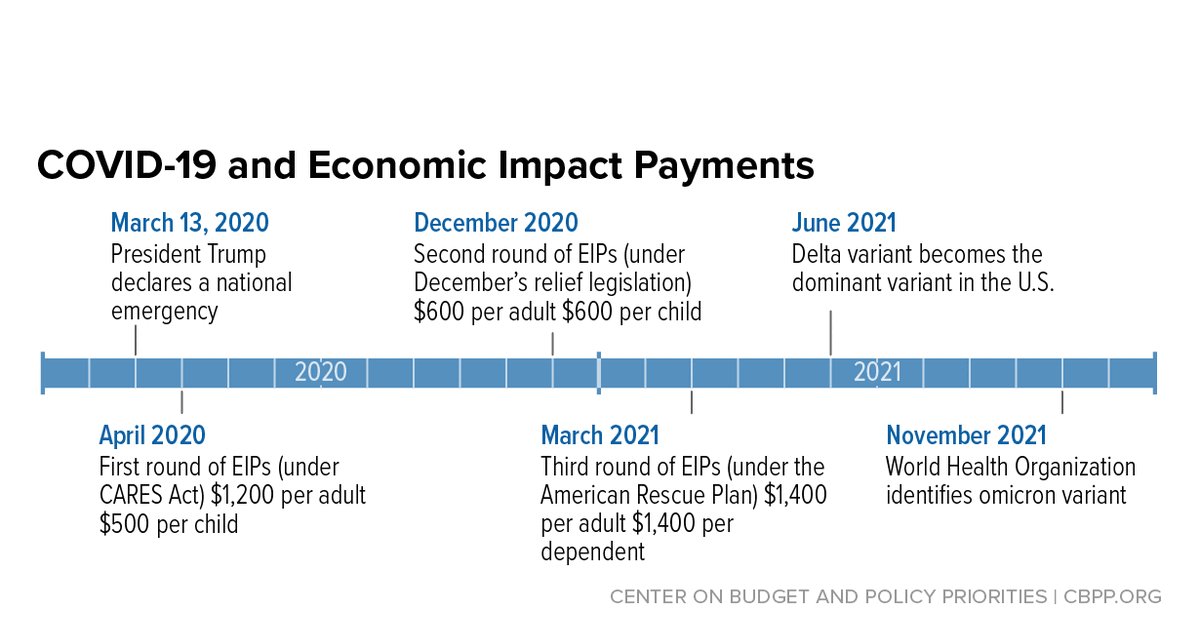

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Child Tax Credit Ctc Get Your Payment Il

Child Tax Credit Ctc Get Your Payment Il

How To Check Supplier Gst Status Status Tax Credits Tax Payment

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

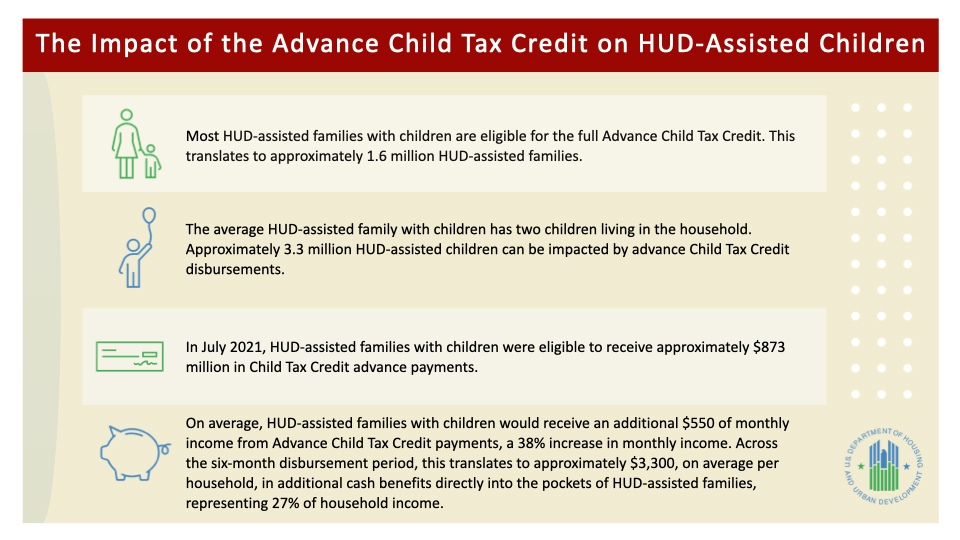

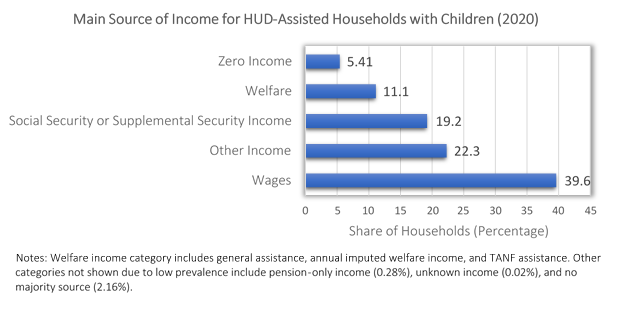

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit What The New Monthly Checks Mean For Your Family Npr

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Parents Guide To The Child Tax Credit Nextadvisor With Time

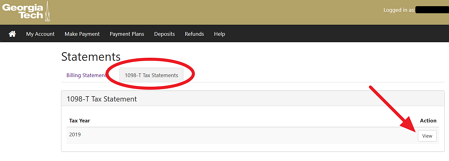

1098 T Faq Office Of The Bursar

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

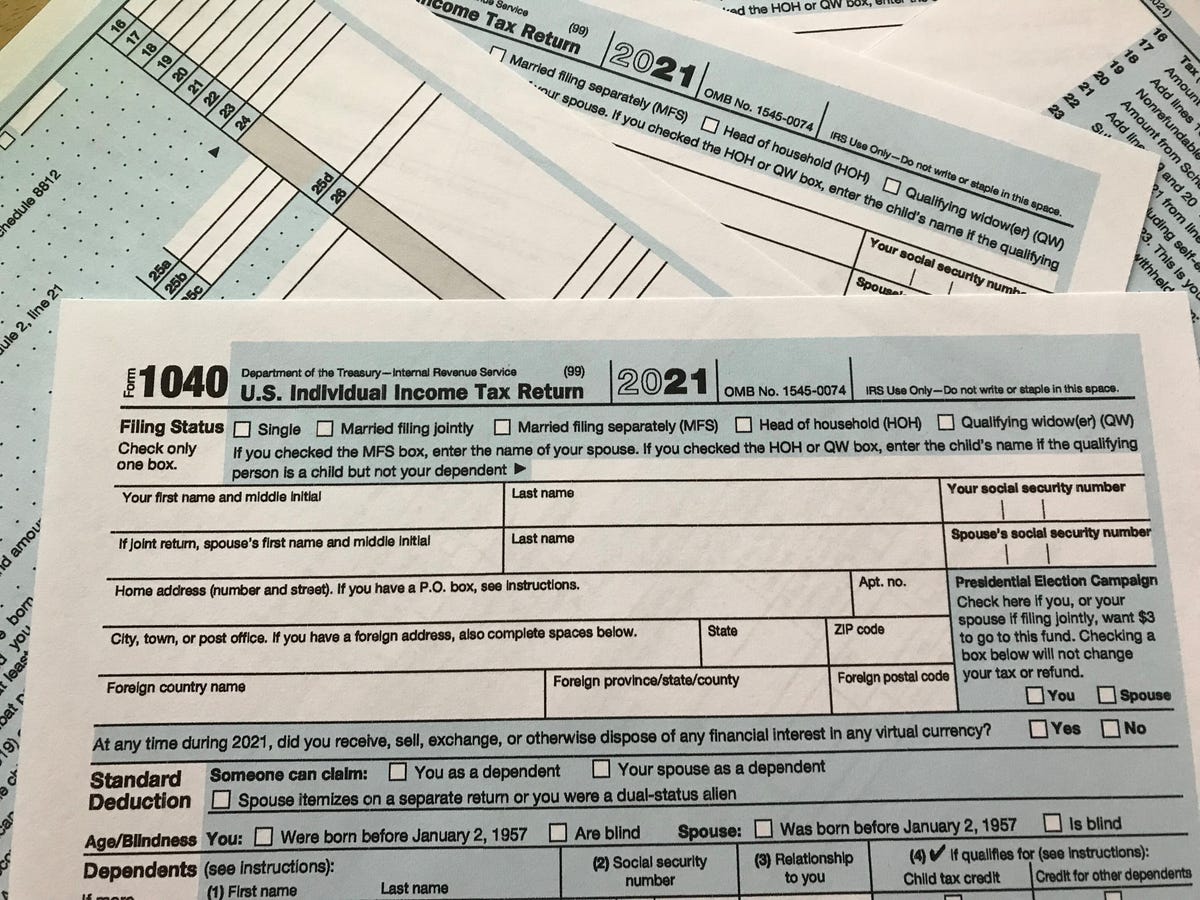

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Childctc The Child Tax Credit The White House

Advance Child Tax Credit Payments Learn If You Need To Pay Money Back Cnet